Get the free form 14157 a

Show details

Form 14157-A Rev. May 2012 Department of the Treasury - Internal Revenue Service OMB Number Tax Return Preparer Fraud or Misconduct Affidavit 1545-2168 Use this form if a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. If Yes define the relationship friend neighbor relative co-worker etc. How did you find out this person prepared income tax returns Did you receive a refund If Yes enter refund amount Enter refund...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 14157 a form

Edit your pdffiller form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 14157 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 14157 a form online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit irs form 14157 pdf. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs form 14157

How to fill out 14157 a?

01

Start by gathering all the necessary information required for the form, such as your personal details, income information, and any additional documents that may be needed.

02

Carefully read through the instructions provided with the form to ensure you understand each section and requirement.

03

Begin filling out the form by providing your personal details, including your name, contact information, and social security number.

04

Follow the instructions to report your income accurately, including any deductions or credits that apply to your situation.

05

Make sure to double-check all the information you've entered before submitting the form to ensure accuracy.

06

Sign and date the form as required, and attach any additional documents requested.

07

Keep a copy of the completed form for your records.

Who needs 14157 a?

01

Individuals who need to report their income and claim deductions or credits on their federal tax return.

02

Specifically, Form 14157 a is used by taxpayers who believe they have been the victim of identity theft or suspect that an unauthorized third party may have used their information fraudulently.

03

By completing Form 14157 a and submitting it to the IRS, these individuals can alert the agency of the potential identity theft and protect themselves from any fraudulent activity.

Fill

form 14157

: Try Risk Free

People Also Ask about form 14157 a tax return preparer fraud or misconduct affidavit

What are good reasons to request an abatement of IRS penalties?

Fires, natural disasters or civil disturbances. Inability to get records. Death, serious illness or unavoidable absence of the taxpayer or immediate family. System issues that delayed a timely electronic filing or payment.

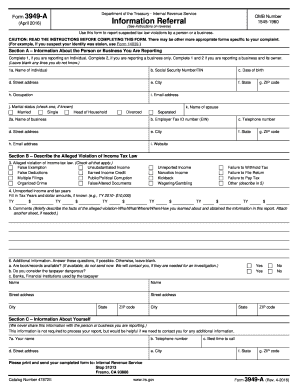

Can you anonymously report someone to the IRS?

Submit Form 3949-A, Information Referral onlinePDF if you suspect an individual or a business is not complying with the tax laws. We don't take tax law violation referrals over the phone. We will keep your identity confidential when you file a tax fraud report.

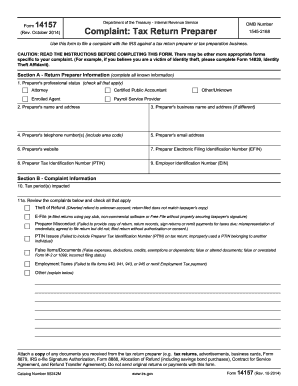

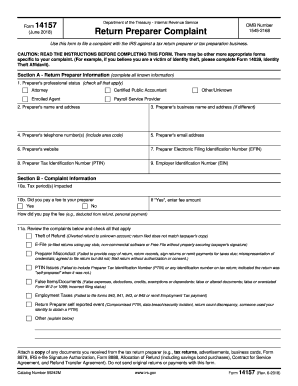

What is the form 14157 and 14157 A?

To file a report with the IRS, use Form 14157, Return Preparer Complaint. If you suspect a tax preparer filed or changed your return without your consent, you should file Form 14157-A, Return Preparer Fraud or Misconduct Affidavit.To file a report with the FTB, submit an online Fraud Referral Report.

Where do I send IRS abatement request?

Send Form 843 to the Internal Revenue Service Center where your return was filed. If the erroneous advice does not relate to an item on a Federal tax return, Form 843 should be sent to the service center where your return was filed for the tax year you relied on the erroneous advice.

What happens when you file a form 14157?

Purpose of Form Use Form 14157 to file a complaint against a tax return preparer or tax preparation business. Tax professionals can use this form to report events that impact their PTIN or business.

What IRS form do I use to request penalty abatement?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify where to send form 14157 a without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your form 14157 online into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I get irs form 14157 a pdf?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the irs 14157 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit 14157a straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing 14157, you can start right away.

What is 14157 a?

Form 14157-A is a form used by taxpayers to report allegations of misconduct by tax preparers or tax professionals.

Who is required to file 14157 a?

Any individual who believes they have been a victim of misconduct by a tax preparer may file Form 14157-A.

How to fill out 14157 a?

To fill out Form 14157-A, provide your personal information, details about the tax preparer, and a description of the alleged misconduct.

What is the purpose of 14157 a?

The purpose of Form 14157-A is to report the alleged misconduct of tax preparers to the IRS for further investigation.

What information must be reported on 14157 a?

On Form 14157-A, you must report your information, the tax preparer's information, and specifics about the alleged misconduct, including any relevant financial details.

Fill out your form 14157 a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form 14157 A Tax Return Preparer Fraud Or Misconduct Affidavit is not the form you're looking for?Search for another form here.

Keywords relevant to tax preparer misconduct form

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.